For many Directors and CFOs in India, the alphabet soup of regulatory compliance can be a source of constant “audit anxiety.” Among the most frequent points of confusion are the terms Internal Financial Controls (IFC) and Internal Control over Financial Reporting (ICFR).

If your company has recently crossed a turnover milestone or is preparing for a statutory audit, you’ve likely asked: “Are these the same thing? Do they both apply to my private company? And why is my auditor asking for a Risk Control Matrix (RCM)?”

At ZMAS and Associates, we believe that understanding these differences isn’t just about avoiding a “qualified opinion” in your audit report—it’s about building a resilient, leak-proof business.

Table of Contents

1. The Core Difference: Scope vs. Reporting

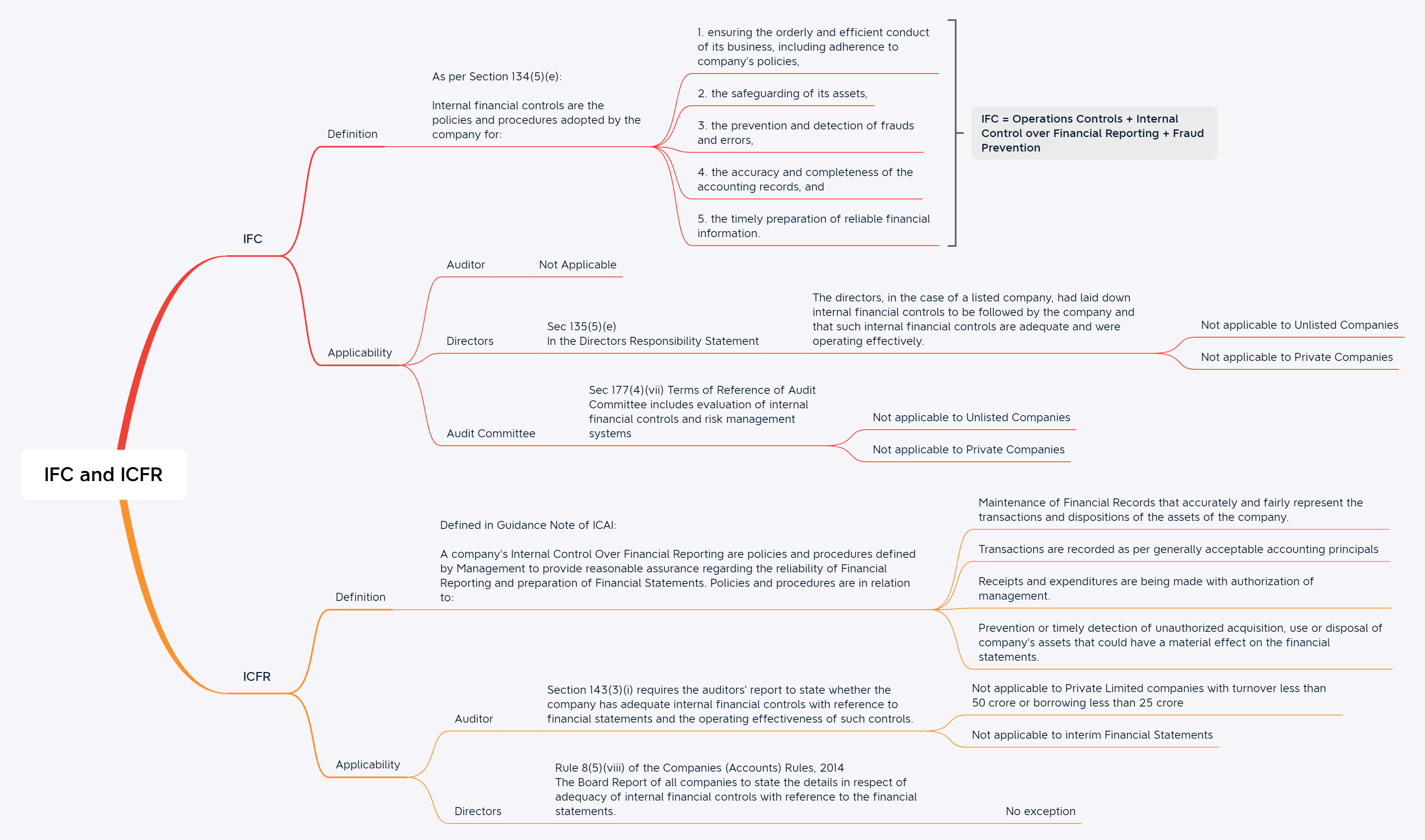

The simplest way to visualize the relationship between IFC and ICFR is to think of a circle within a circle.

What is IFC? (The Big Picture)

Under Section 134(5)(e) of the Companies Act 2013, Internal Financial Controls (IFC) refers to the policies and procedures adopted by the company to ensure:

- Orderly and efficient conduct of business.

- Adherence to company policies.

- Safeguarding of assets.

- Prevention and detection of frauds and errors.

- Accuracy and completeness of accounting records.

IFC is the Board’s responsibility. It covers everything from how you hire employees to how you authorize a multi-crore purchase order.

What is ICFR? (The Auditor’s Focus)

Internal Control over Financial Reporting (ICFR) is a subset of IFC. It focuses strictly on the controls that ensure your financial statements (Balance Sheet, P&L) are reliable and free from material misstatement.

Under Section 143(3)(i), the Statutory Auditor is required to report on whether the company has adequate ICFR in place and the operating effectiveness of such controls.

2. Applicability: Does Your Company Need It?

Based on the Companies Act 2013 and subsequent exemptions, here is a quick breakdown of who needs what:

| Category | IFC (Board Reporting) | ICFR (Auditor Reporting) |

| Listed Companies | Mandatory | Mandatory |

| Unlisted Public Companies | Required to have “Adequate” controls | Mandatory |

| Private Companies (Turnover > ₹50Cr OR Borrowings > ₹25Cr) | Required to have “Adequate” controls | Mandatory |

| Small Companies / One Person Companies (OPC) | Exempt | Exempt |

ZMAS Note: Even if you are technically “exempt” from auditor reporting (ICFR), the Directors are still legally responsible for the “safeguarding of assets” and “prevention of fraud.” Relying on an exemption is not a defense if a major financial leak occurs due to poor internal oversight.

3. Why the Confusion Leads to Risk

Many companies treat ICFR as a “year-end activity” to satisfy the Statutory Auditor. However, focusing only on ICFR while ignoring the broader IFC framework creates a “Control Gap.”

For example:

- ICFR View: As long as the invoice is recorded correctly in the ERP, the financial reporting is “accurate.”

- IFC View: Was the vendor selected through a fair bidding process? Is the price competitive? Does the vendor actually exist?

If you only focus on ICFR, you might have perfect books but a business that is losing money through procurement fraud or operational inefficiencies.

4. The ZMAS Approach: Building a Risk Control Matrix (RCM)

When ZMAS steps in to implement or audit your controls, we don’t just look at vouchers. We build a Risk Control Matrix (RCM). This document is the “map” of your business’s safety net.

- Identify the Risk: What could go wrong? (e.g., “Duplicate payments to vendors.”)

- Identify the Control: How do we stop it? (e.g., “ERP system blocks identical invoice numbers.”)

- Test the Effectiveness: Does it actually work? (We run “walkthrough” tests to verify.)

5. Moving Beyond Compliance to Value

A robust IFC framework (designed by specialists) offers benefits that go far beyond a clean audit report:

- Investor Confidence: If you are looking for PE/VC funding or an IPO, a strong IFC framework significantly increases your company’s valuation.

- Operational Efficiency: Identifying redundant processes saves time and manpower.

- Fraud Deterrence: A “Control Conscious” culture discourages employees from attempting fraudulent activities.

Conclusion: Don’t Wait for the Audit Month

The biggest mistake a growing company can make is starting their IFC/ICFR documentation in March. By then, it’s too late to fix “design gaps” or show “operating effectiveness” for the full year.

At ZMAS and Associates, we specialize in helping companies bridge the gap between “what the law requires” and “what the business needs to grow safely.” Whether you are a private company hitting the ₹50 Crore turnover mark or a public entity looking to tighten your ERM, we are here to guide you.

Is your company ready for its next audit?

Would you like us to perform a “Gap Analysis” of your current Internal Financial Controls? Contact ZMAS and Associates today for a consultation.

Recent Comments