Table of Contents

Applicability of Internal Audit as per Law

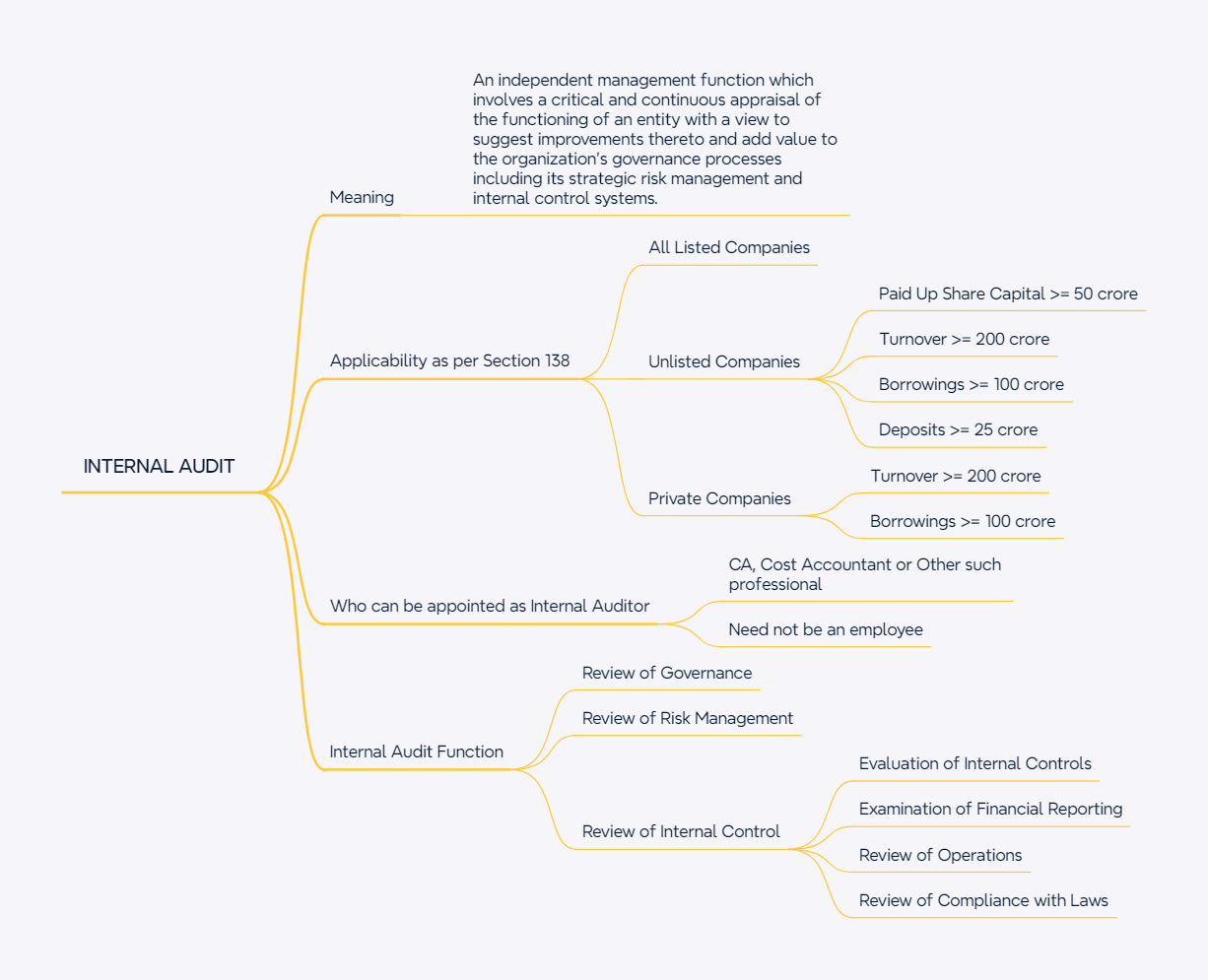

No, internal audit is not mandatory for every company in India. The requirement for internal audit is governed by Section 138 of the Companies Act, 2013 and applies only to certain classes of companies, as prescribed by Rule 13 of the Companies (Accounts) Rules, 2014.

Internal Audit is Mandatory For:

- Listed Companies

- All listed companies must appoint an internal auditor.

- Unlisted Public Companies meeting any of the following:

- Paid-up share capital of Rs. 50 crore or more during the preceding financial year.

- Turnover of Rs. 200 crore or more during the preceding financial year.

- Outstanding loans or borrowings from banks or public financial institutions exceeding Rs. 100 crore at any point during the preceding financial year.

- Outstanding deposits of Rs. 25 crore or more at any point during the preceding financial year.

- Private Companies meeting either of the following:

- Turnover of Rs. 200 crore or more during the preceding financial year.

- Outstanding loans or borrowings from banks or public financial institutions exceeding Rs. 100 crore at any point during the preceding financial year.

As per explanation attached to this rule, the internal auditor may or may not be an employee of the company.

Proviso to this rule, mentions that, an existing company covered under any of the above criteria shall comply with the requirements of section 138 and this rule within six months of commencement of such section.

Is it advisable to voluntarily opt for internal audit even when not mandatory?

Opting for internal audit voluntarily, even when not mandated, can offer several strategic and operational benefits to a company. Here’s a breakdown of key advantages:

1. Improved Internal Controls

- Helps identify weaknesses or gaps in internal processes.

- Strengthens checks and balances to prevent fraud and errors.

2. Enhanced Risk Management

- Identifies financial, operational, and compliance risks early.

- Helps develop risk mitigation strategies proactively.

3. Better Regulatory Compliance

- Keeps the company prepared for external audits and inspections.

- Ensures adherence to applicable laws, rules, and industry standards.

4. Operational Efficiency

- Reviews operational processes to identify inefficiencies.

- Recommends process improvements, leading to cost savings.

5. Strategic Decision Support

- Provides management with objective and timely insights.

- Aids in data-driven decision-making based on internal performance.

6. Fraud Detection and Prevention

- Regular reviews can uncover irregularities or suspicious activities.

- Acts as a deterrent against employee misconduct.

7. Improved Stakeholder Confidence

- Investors, lenders, and partners may view the company as more reliable and well-governed.

- Builds trust in financial reporting and governance practices.

8. Preparation for Growth or IPO

- Sets up robust systems in anticipation of scaling or going public.

- Helps transition smoothly to mandatory audit requirements in future.

Let us look at a real-world anonymized case study to understand how voluntary internal audit has helped a company:

“ZFPL” A private limited company – Voluntary adoption of Internal Audit for Operational Strengthening

Background

- Company Type: Private Limited

- Sector: Packaged food manufacturing

- Turnover: Rs. 180 crore (internal audit not mandatory)

- Growth Stage: Expanding to new cities, planning to raise private equity

The Challenge

ZFPL was scaling fast but started facing:

- Rising inventory mismatches

- Delayed vendor payments

- Suspicions of billing fraud in regional warehouses

- Low investor confidence due to lack of transparent controls

Voluntary Internal Audit Decision

Management appointed a professional internal audit firm to:

- Review procurement, warehousing, and finance processes

- Assess internal controls and risks

- Identify process bottlenecks and leakages

Audit Findings

- Multiple warehouses bypassed standard purchase procedures

- Ghost vendors were being paid small but frequent amounts

- Inefficient cash flow due to poor debtor follow-up

- Lack of segregation of duties in the finance department

Post-Audit Improvements

- Introduced maker-checker controls in payments

- Automated inventory management with barcoding

- Set up an internal audit committee to review red flags quarterly

- Cleaned up vendor database and implemented KYC

Results

- Rs. 2.5 crore saved annually from tighter controls

- Reduced debtor days from 95 to 60

- Investors appreciated proactive governance, leading to successful Rs. 40 crore funding round

- Now preparing for a possible IPO in 3 years

Key Takeaway

Even though ZFPL wasn’t required to conduct an internal audit, doing so strengthened governance, improved operations, and increased investor trust — positioning the company for sustainable growth.

Recent Comments